welcome to bless the mess

As a wife, mom and organizer, my goal is to empower homeowners to find balance in their homes and minds through organization.

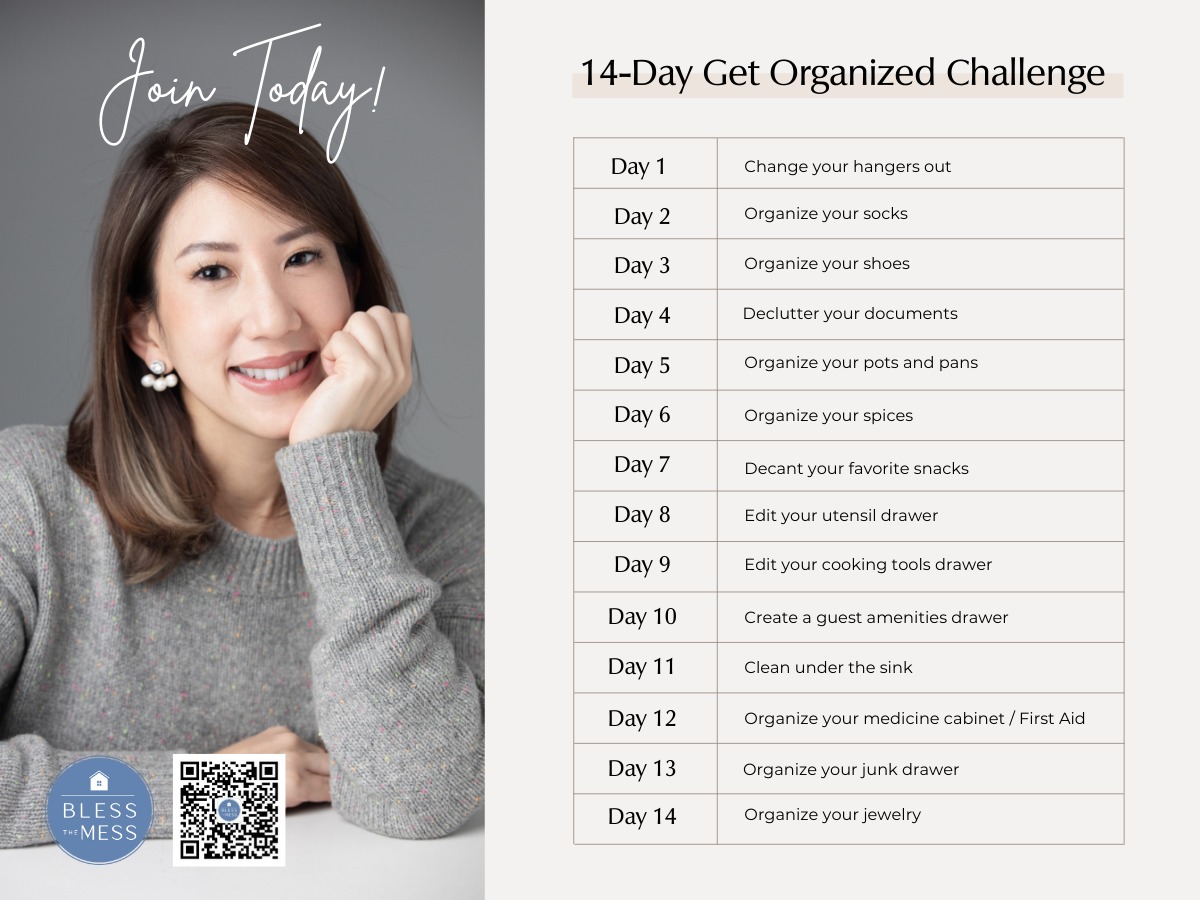

Join the 14 Day get Organized Challenge

This 14-day challenge is designed to help you make small changes each day and get into the habit of organizing.

Join Now

As we’re getting organized at home, financial paperwork and budgeting may not be our first thought. But you know what? Teaching our kids some basic money smarts early on can set them up for a life where they won’t feel that constant need to fill up their space and lives with more stuff.

From personal experience, once my son learned the value of a dollar and how to truly budget, he became way more thoughtful about his spending. He doesn’t just impulsively want the latest toy or gadget anymore. By equipping our little ones with money knowledge and skills from an early age, we’re building the foundation for them to feel secure and content, without relying on material things to find that happiness.

In this guide, I’ll share some practical tips for introducing financial concepts to kids in a fun, easy way. With the right tools and habits, we can instill healthy attitudes about money that will serve them for life. Let’s dive in!

7 Building Blocks of Financial Literacy

Budgeting: How to Balance Income and Expenses

This is such an important skill to teach our kids – how to balance what’s coming in with what’s going out. Budgeting helps them truly understand the value of a dollar and make smart choices about spending.

It’s easy – just have them track their income (allowances, gift money, etc.) and what they spend it on (video games, snacks, you know how it goes!). Then encourage them to think about true needs versus those impulsive wants. Do they really need another toy this week? Or would it be better to save up for something bigger they’ve been eyeing?

Getting hands-on with budgeting worksheets or apps is ideal. As they see their money dwindling from wants versus lasting for needs and savings goals, those real-life lessons will start clicking. They’ll understand firsthand how spending without planning can leave them disappointed. It’s an “aha!” moment toward making smarter money decisions.

Saving and Goal-Setting: The Path to Financial Freedom

Once budgeting clicks, it’s time to get them excited about saving! Delaying gratification for a bigger goal is such a powerful mindset. Have them pick some fun short-term goals to save towards – a new video game, a bike, whatever gets them motivated. Then also inspire them with bigger dreams like saving for college or their future.

A clear piggy bank or kid’s savings account is perfect for this. As they watch that balance grow from weeks or months of added allowance, it’ll feel like accomplishing a hard-won achievement. Imagine how happy they’ll be taking that pile of cash to finally buy their long-awaited toy!

Be sure to celebrate each milestone along the way with high fives, treats, or whatever jazzes them up. It reinforces that delaying a want isn’t deprivation – it’s the path to bigger and better goals. When they make the connection between saving and reaching their dreams, you’re instilling priceless motivation.

Earning and Understanding the Value of Money

Next up, let’s help them truly appreciate that money has to be earned through effort. Kids can tie allowances or cash gifts to completing chores or tasks. Tough work, even if it’s just a few hours, will make them value their hard-earned dollars so much more.

Have open conversations about how money doesn’t magically appear – it represents traded time and energy. Maybe Mom has to work a 9-5 job, or Dad runs his own business with long nights. Relating their “work” like chores to your jobs helps build perspective.

Then be sure to draw the line between true needs like food, shelter, clothes – and wants like toys or entertainment. They’ll start prioritizing what matters most when they understand money’s deeper meaning.

Using Cash and Cards Responsibly

As they get older, slowly introduce concepts like cash, debit cards, and credit cards. In an age of instant online purchasing, it’s crucial they respect the power of plastic. Explain how debit cards access their own money while credit cards borrow funds that must be repaid.

Drive home the importance of safe spending limits to avoid debt. Maybe share a story of a maxed-out credit mistake from your past as a careful warning.

To start building familiarity, have them use cash for small purchases like snacks or outings. Physically handing over dollar bills and watching their money depleting makes spending so much more tangible than swiping a borderless card. This lays the groundwork for controlling idle impulse buys.

Charitable Giving: The Joy of Giving Back

While building smart money habits is empowering, it’s also important to nurture generous spirits. Once budgeting and saving become routine, have them allocate a percentage toward charitable donations.

Maybe they want to give a portion to their school, church, or cause they care about like animal rescues or environmental groups. Don’t just tell them it’s the right thing to do – have open conversations about how amazing it feels to help others in need.

When they cheerfully part with a slice of their hard-earned cash, it reinforces prioritizing what truly matters over meaningless splurges. You’re instilling priceless values of empathy and community giving. Just think of the warm fuzzies when you describe how their funds made a difference!

A Tactile Connection in a Digital World

I also want to emphasize that here in our digital world, it’s easier than ever for money to feel like monopoly money to kids. With mobile payment platforms like Alipay and WeChat Pay, transactions happen with just a tap – the actual concept of earning and spending cash can get really abstract.

That’s why I highly recommend still giving allowances in physical cash and having them put it in an old-school piggy bank or one of those toy ATM machines. There’s just something powerfully tangible about watching that money pile up over time from their hard work.

And absolutely take them to actual toy stores sometimes rather than always online shopping. Let them walk the aisles, pick items up, and pay the cashier themselves. When they can physically hand over dollar bills for that coveted toy, they’ll learn to prioritize and really appreciate what they’ve spent their money on. It drives home the value of a dollar in a way those digital pay buttons just can’t.

We’re raising the first truly cashless generation. So we have to be intentional about creating experiences that keep money real and rewarding for them through all their senses – sight, touch, satisfaction. Those tangible money lessons will stick for life.

Lead by Example

Of course, kids will do as we do, not just as we say. The best way to make these lessons stick? Living them out loudly!

Get them involved as you handle real budgeting, bill paying, and financial decisions. Talk through your thought process out loud as you spend, save, and make money choices. Celebrate smart decisions and analyze mistakes as learning experiences.

When they see you passing on impulsive wants to save up for bigger goals, or donating to meaningful causes, those actions will leave a profound impact. If you still struggle with money discipline, acknowledge that too – we’re all works in progress!

Consistent money conversations and hands-on practice will turn financial literacy into an intuitive lifelong skill. It’s one of the most priceless gifts we can provide our children for their future success and well-being.

Can you think of someone else who may find this article beneficial? A friend with young kids, or a new parent trying to get a head start on financial lessons?

Money management is one of those critical life skills that’s so valuable to instill from an early age. The sooner we can put kids on the right path with budgeting, saving, and understanding the value of a dollar, the more prepared they’ll be to make smart choices as adults.

So go ahead – share these tips with other parents in your life! The more we can spread financial literacy and inspire the next generation of money-savvy kids, the brighter their futures will be. Let’s make talking about money management as natural as playdates and family dinners.

Every share helps make a positive impact. Who knows, you may even pick up some new wisdom by discussing these concepts with other caring parents. It truly does take a village to raise financially responsible adults!

Before you go…

MAKE SURE TO FOLLOW US FOR MORE GOOD IDEAS

Instagram | Facebook | Little Red Book | Wechat

You can also contact me or subscribe to my newsletter here.

PIN IT FOR LATER ↓

Leave a Reply Cancel reply

Bring Tidy Home

with Our Newsletter.

Receive our free resources and stay up to date with the latest blogs, organization challenges, events, and more!

Thank you!

You're subscribed to our newsletter. We'll notify you when we release new freebies and when new blogs get published.

You may Also Enjoy...

browse the latest posts

Explore

Blog

© 2022. BLESS THE MESS, ALL RIGHTS RESERVED

| TERMS | PRIVACY | MADE WITH ♡ BY zehn

find me on instagram @bless_the_mess_

find me on instagram

Get Organized Challenge

Commit to Organize Your Life in 14 Days

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse eu lacinia metus. Quisque lacinia mi vitae nunc sollicitudin, a dignissim sem imperdiet.

Join Now

添加我的微信号

微信ID:blessthemess-sh